An hour or two of time the tax tips below can earn you an extra $500-$3,000 this year. Don’t let the small task of tracking mileage cost you (because you didn’t do it). If you’re an independent contractor or business owner, you can deduct money from your income for the miles traveled in your car to the gym you work at or clients homes as long as you have a “home office” as your starting place.

A home office is a designated space in your home for work. It can be as small as a desk in the corner of a room or an entire room. Make sure it’s for business only! The IRS doesn’t allow you to deduct for “commuting” which means from home to work. The IRS only allows you to deduct mileage from work to places of business.

For example:

Gym to clients home = BUSINESS $$$

Your home to gym = not business

Your home to clients home = not business

Your home office to gym or clients home = BUSINESS $$$

So, get a home office set up and keep reading…

How Do Mileage Deductions Work?

The easiest way to deduct mileage is to take the standard deduction for mileage, which is an amount predetermined by the IRS. If it’s $0.55/mile, multiply it by the miles you traveled that year.

For example:

20,000 miles x $0.55 = $11,000. You can deduct $11,000 from your total income, saving you on taxes.

If your taxes are at 25% for state and federal combined, than you would save 0.25 x 11,000 = $2,750.

I’d say $2,750 is worth keeping track of mileage for the year! Yours might be more or less, depending on how much you drive your car between places of work.

Alternatively, you could deduct your actual car expenses for the year (gas, maintenance, etc.), which means keeping track of mileage and all expenses. Most people say this is more complicated and the two methods come close in how much they save you. This might save you more, but is more work. Which ever you choose to do, make sure your records are organized and detailed in case you get audited. This goes for any tax deductions you claim for your business.

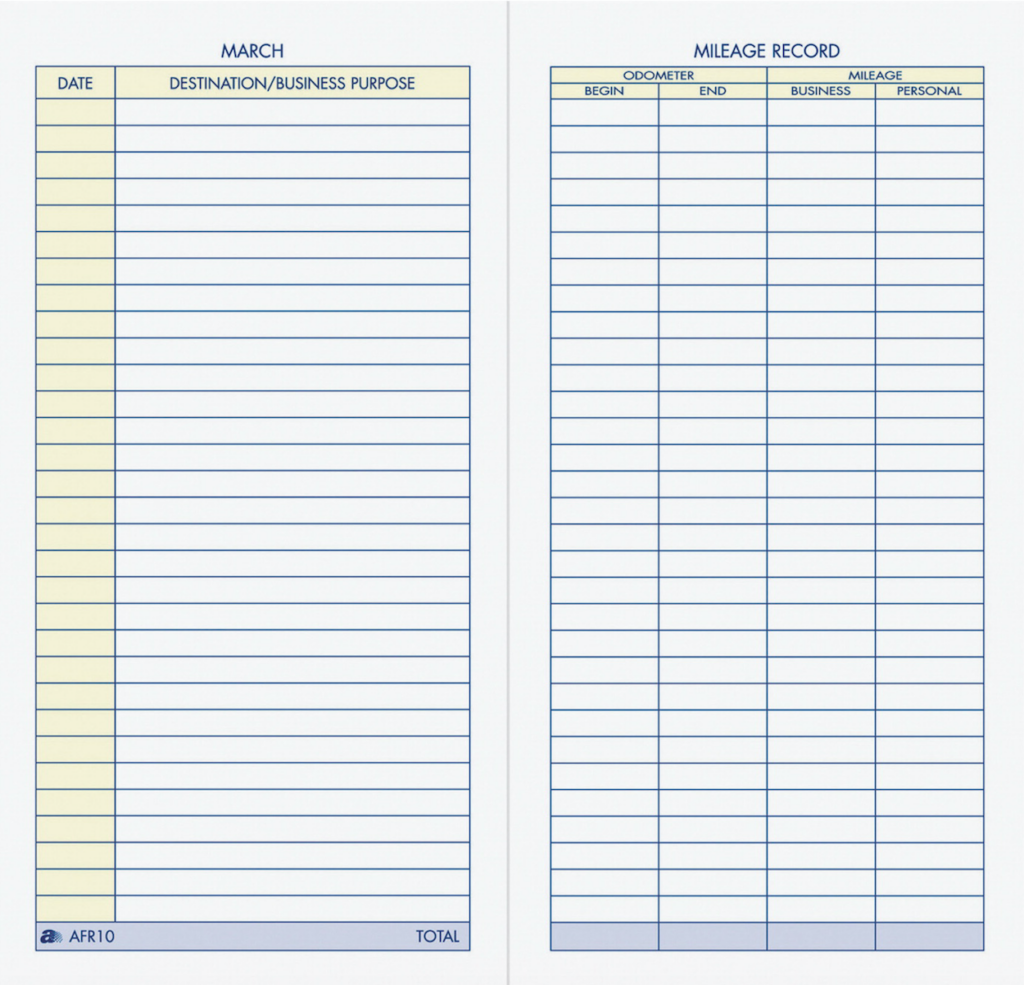

Old School Tracking

You can buy mileage tracking books that are small and easy to keep in your car console or glove box on Amazon or at office supply stores like Staples and Office Depot. The hard part is remembering to log the miles! Place a note or sticker near your dashboard that reminds you to mark the mileage on your odometer when you get in the car to go to the gym for work or a clients home. Every time you get in the car, note the mileage and how much is driven for work purposes. It’s a habit just like tracking calories or workouts. You’ll get used to it.

There’s also an App For That – If you’re more tech inclined, MileIQ is an app you can download to your smart phone and have it track the miles for you!

Is it too late to log at the end of the year?

If you’ve been traveling this year, but didn’t keep track it’s not to late. If you can back track your trips for the year, it might take a couple hours to create a log. If it saves you even $100, I’d say it’s worth your time. Record the date, destination and miles.

**This information is educational and not meant to replace advice from an accountant. Always seek professional council before deducting money on your tax return. And refer to the IRS website for more details.

References and Resources

Tax Planning for Personal Trainers: Getting Organized