Some personal trainers bring home the bacon in the fitness industry, while others are just barely scraping by. Regardless of how much money a personal trainer makes they almost always want to earn more. Maybe it’s because most people spend more money when they make more money. Sometimes this is a conscious decision and sometimes it’s not.

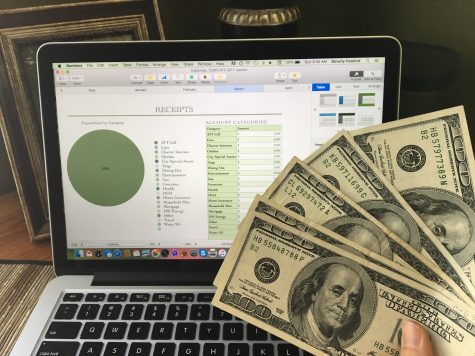

To make conscious financial decisions as a certified personal trainer and reveal what’s really happening in your financial life you can track spending. It’s similar to having clients keep a food journal or workout log.

Tracking expenses helps you raise awareness of your financial health and realize how much money you really need to earn a decent living. You may be better off than you realize… And you may be your own worst enemy!

How often are you swiping your credit card? Let’s do a financial fitness assessment now…

Calculating your expenses in four easy steps

1. Calculate your fixed expenses. Identify necessities like food, rent, phone, internet, car insurance, and personal trainer certification. There are many things you spend money on that have a calculated cost throughout the year, whether it’s monthly, annually or bi-annually.

You might pay certain bills like car insurance twice a year. In this case, take the yearly total (multiply the bill times two if bi-annual) and divide it by 12. For example, if it’s a $600 payment twice a year then it’s $1,200 for the year. $1,200/12 = $100/month.

Grocery bills usually change from week to week, but you can figure out a monthly average by looking back at credit card statements or keeping track from now on. This could also be a variable expense if you prefer…

2. Calculate your variable expenses. Everyone likes to grab a smoothie or coffee out occasionally (or perhaps, frequently). Other items like travel, entertainment, and clothing purchases also fit into this category. They are more unpredictable and not necessary to live – but things that most of us are used to having in life.

These are often the hidden expenses that weigh us down, like unnecessary calories…

You have two choices. Either look back at your credit card and bank statements from last year to see how much you spent and on what. Many banks offer spending breakdown graphs and charts, which you should be taking advantage of. Or, move forward and start keeping track now. It’s a good habit to get into anyhow and the only way to keep tabs on how often you swipe your credit card.

3. Record your expenses. Use a spreadsheet, a program like Quickbooks, or an app to track your spending each month from now on, whether you decide to backtrack or not.

- Use your credit card statement to tally up your purchases at the end of each week or month.

- If you pay for something with cash, remember to get a paper receipt, and then file them in the same place.

- Locate checks by looking at your bank statement.

You could use a program that keeps records of each swipe of your credit card. There are many options available to suit your financial fitness level.

As the months go by you’ll see what you need to spend money on and what’s extra or unnecessary. You can mark your spending as “non-negotiable” or “negotiable” in your spreadsheet. This helps you decide what to cut out if you are scraping by financially. It also helps you see how much money you need to earn to get by. It’s often less than we realize.

4. Mind your expenses. Once you know what’s happening in your financial health life you can trim away the excess. Financial cardio! If you tend to spend between $500-$1,000 monthly on food, consider making $700 your monthly limit–or less if you’re trying to save money. That may mean eating out less, choosing more economical products, or even switching to a discount grocery store. Consider, however, if healthy, organic food is too much of a priority for you to compromise on. That’s ok! Find other places to trim the fat.

Have you identified anything else you’re spending money on that’s unnecessary or that isn’t contributing to your larger life goals? Sometimes it’s a matter of making choices.

For example: Which is important to you? Daily coffee (which can add up to $20/week and $80/month quickly). Or paying off a credit card? Or funding a weekend away from work?

Many of my business coaching clients aren’t actually broke, they’re just making misaligned choices. Only you can know what the best choices are for you, based upon your values and goals in life. Does this sound like any of your personal training clients? Most of them aren’t doing anything wrong when they come to see you, just wanting one thing and doing something else.

Financial results

This new habit takes time to cultivate, just like new health routines do for your clients. If you’re not doing any financial planning, start small. Be consistent. Do something that seems easy for you right now and go from there. Make it a part of your lifestyle. Just like fitness is.

Keeping track of expenses over the course of a month or a year builds financial awareness. It becomes second nature – like choosing healthy foods. Expense tracking helps you make informed choices about your life. You can use this information to help you choose where you rent gym space, to negotiate gym rent and for setting your personal training prices. Because now you know how much money you need to make a living.

In a future post we’ll talk about tracking income. Stay tuned in to the NFPT Blog.

Need help with the numbers? If you’re an NFPT trainer, join the Facebook Community Group to ask us and if you’re not, come chat with NFPT here! We’ll do our best to help you sort through your numbers.